Late Property Tax Protesting: What You Need to Know

January 31 is a key deadline for certain late property tax protest filings in Texas. Property owners and their representatives may still be able to pursue a late protest or correction, even if the original deadline was missed.

Who This Applies to:

This information is intended for property managers, agents, representatives and others responsible for commercial, multifamily, industrial, or retail properties in Texas who may have missed a prior property tax protest deadline. If you manage or represent multiple properties, understanding whether late options may still exist is especially important as statutory deadlines approach.

What to Know About Late Property Tax Protests:

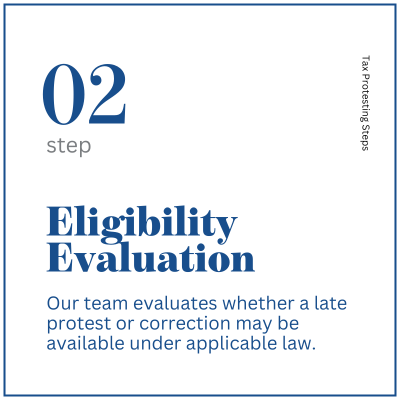

Late property tax protests are not available in every situation

Eligibility depends on specific facts, notice issues, and jurisdictional rules

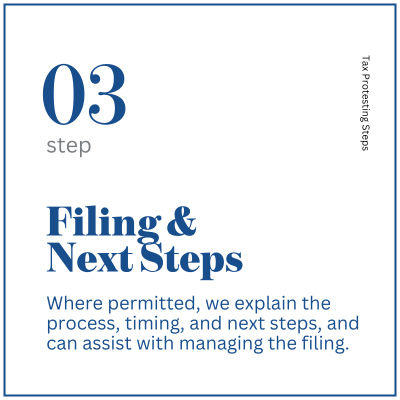

Property taxes must still be paid by the January 31 deadline; however, payment of taxes does not prohibit further review or the pursuit of certain late protest or correction options

These matters are time-sensitive and governed by statute

January 31 is often the final date to initiate certain late filings or corrective actions for the prior tax year.

Why This is Important:

Late property tax protests and corrections involve procedural requirements that differ from standard, timely protests. Whether an option may still be available depends on how notices were delivered, valuation thresholds, and statutory provisions that vary by circumstance.

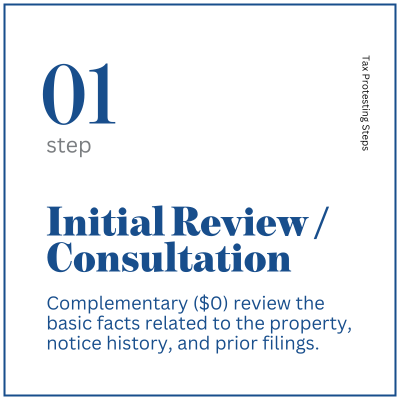

We can help:

Determine whether a late protest or correction may be permitted

Determine what documentation is required

Determine whether pursuing relief makes sense under the circumstances

Manage and handle next steps for you